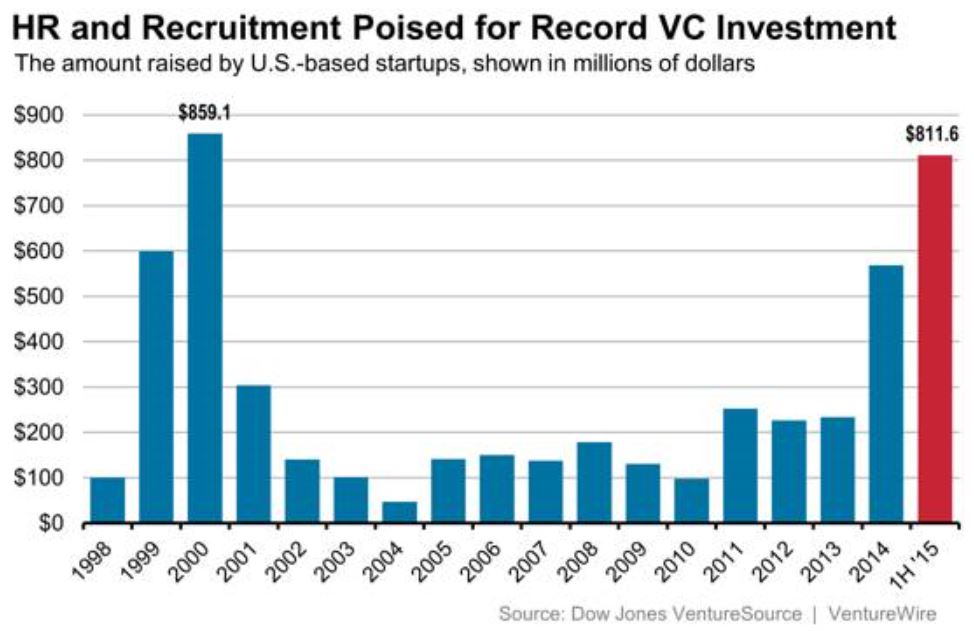

Billions of dollars invested in HR technology companies have created a handful of new and reborn one-size-fits-all HCM vendors who made a big splash on the HR scene throughout 2015 and 2016. Not to be outdone, niche HR specialist vendors have upped the ante with some very compelling niche products targeting recruiting, performance, learning, compliance, and social collaboration. Choice is always a good thing for HR departments. How does all this investment in HR technology companies change the way HR executives think about using technology within their operations?

Billions of dollars invested in HR technology companies have created a handful of new and reborn one-size-fits-all HCM vendors who made a big splash on the HR scene throughout 2015 and 2016. Not to be outdone, niche HR specialist vendors have upped the ante with some very compelling niche products targeting recruiting, performance, learning, compliance, and social collaboration. Choice is always a good thing for HR departments. How does all this investment in HR technology companies change the way HR executives think about using technology within their operations?

To best-of-breed or not to best-of-breed? That is now the question.

There is no question that current thinking leads HR executives toward single-vendor-fits-all approach for HCM over using multiple best-of-breed niche software providers. The best-of-breed approach may gain favor as convenient and reliable data exchange service to core HR platforms mature. I’m seeing this trend occur with SMB accounting and sales automation providers now supporting data exchange to financial institutions, POS, fulfillment services, lead sources, and even benchmarking data. I expect the HR space to follow suite making a best-of-breed solution approach more viable for HR executives to consider in the future.

A new category is born—The Social Workplace.

Facebook, Google, and Microsoft are all well-positioned to Socialize the workplace. Social tools at work have the potential to reinvent tracking time, electing benefits, performance management, training, and coaching. This goes much deeper that LinkedIn or Glassdoor—think Facebook, SharePoint, and GoToMeeting combined. In fact, Facebook is already in the game with Workplace by Facebook (https://workplace.fb.com/) launched in late 2016. Gaining access to the employee’s wallet will be the holy grail for Social Workplace vendors, and HR is positioned as the epicenter to be the gatekeeper and policy maker for this new category. I’m concerned that many HR executives are too overwhelmed with day-to-day workload to properly address this opportunity. So, jumping into bed with Facebook may be convenient but not in their companies’ best interests. There are so many issues to consider: security, privacy, data ownership, productivity, etc. It’s HR’s ball to carry right now, and I’m hopeful that HR executives prioritize their time so they can lead the charge to carefully, thoughtfully, and safely deploy Social Collaboration in their workplaces.

Regulations grow exponentially; strategic outsourcing is HRs only hope to keep up.

With all good intentions government continues to burden companies with new reporting and regulation. With the expansion of E-Verify, EEOC, health and welfare laws, efforts to curb tax refund fraud and change tax brackets, the coming compliance burden continues to grow. We’ve learned from the ACA that new employment laws can be anything but a routine and predictable compliance job during their initial rollout. Already understaffed HR departments should strategically outsource these duties to specialists because when you bake in the true cost of doing the work yourself, outsourcing is truly more affordable and reduces compliance failure risks at the same time.

On premise software bites the dust.

Technology investments have favored Cloud vendors exclusively since investors like the advantages of the Cloud business model with shorter development cycle times, a single code base across the customer base, a streamlined support experience, and out-of-the-box integrations with third-party vendors. These things are all made possible by the Cloud software business model. The Cloud business model also does away with version upgrades costs and aligns customer and vendor interests around a stable and compelling product version which reduces the demand for support. That benefits both parties. Vendors are rewarded with lower costs and clients are rewarded with a better product and lower total cost of ownership. As most software vendors exclusively align their products to cloud deployment, on premise software becomes a relic of the past.

The billions of investment dollars in the HR technology space over the past five years has created new choice for HR departments. HR executives should look to outsource the increased burden of compliance to leave them bandwidth to focus on strategic technology investments such as Social Workplace tools and Human Capital Management software. Arguments will still be made for a single vendor solution, but a best-of-breed approach may gain more favor soon. Either way, HR needs to exercise caution with adequate due diligence in the vendor selection process. Don’t pick a vendor solely on technology demonstrations. A vendor that is too focused on feature-packing and super growth and not enough on customer service can be a nightmare to deal with. Nothing can make up for bad partner choices and failed implementations. The cost, aggravation, disruption, loss of time, and negative hit to your reputation as an HR leader is unrecoverable.