By Richard Cangemi

A People Operations Digital Transformation project can take on different looks and priorities but the goal is always the same. The transformation project strives to make talent and technology seamlessly connected creating processes that are more efficient with happier workers that drive greater business value.

A few examples of digital transformation objectives are:

- Going paperless with electronic employee onboarding, e-documents, benefit enrollment, and performance reviews.

- Delivering training and learning courses virtually.

- Connect employees to the company and managers by giving them a relevant voice and recognition for milestones and achievements using 360 feedback tools such as online chat, badging, pulse surveys, and company news feeds.

For those new to the digital transformation process or new to People Operations, the following five steps are a good place to start your planning.

1. Assess the current state of your People Operations across your organization

The idea here is to understand how your current business processes work. Ask yourself: are we reasonably meeting the current demands of our business, customers, and employees? Involve your stakeholders and get buy in into the best way forward. Identify the potential areas of improvement and how PeopleGuru digital technology can contribute to your long-term business goals. Document your current state and areas that can be improved by the PeopleGuru deployment.

2. Define your People Operations transformation objectives.

Once you know the main pain points within your People Operation, you need to understand what exactly you want to transform. And don’t transform just for the sake of transformation. Make sure each initiative has a specific purpose. You should identify the business processes that could be streamlined, cost reductions, data points that matter most, or competitive advantages that you will gain. You goal should be to document your People Operation transformation objectives and gain signoff from all stakeholders.

3. Outline your People Operations transformation roadmap

An incremental approach to your transformation is always the most practical. Prioritize the areas for improvement that are most impactful and move systematically toward your goals. Set milestones and celebrate success along the way. This will help you keep the process on track and minimize the chance of failure.

4. Establish Clear Project Leadership

A dedicated team with a strong internal leader is essential for ownership of the implementation of your People Operations transformation strategy. If you already have qualified staff in-house, you should assign responsibilities according to your strategy and your staff’s aptitudes. If not, you best option might be to temporarily augment your staff to fill in the areas of expertise that you need.

5. Empower and educate your staff

Don’t let your People Operations transformation efforts be in vain because your employees refuse to adapt to change. Be sure that your corporate culture keeps up with the transformation agenda. Communicating to your staff the why for change will help you gain full buy-in to your transformation agenda.

The key to every transformation project is great planning, leadership, and communication. And the latter can’t be understated. Taking extra time to inform staff about the benefits of their new tech tools and improved work processes must not be overlooked or underplayed. Having all stakeholders bought-in to your transformation agenda will help ensure that any hiccups in your digital transformation project won’t slow or stall your overall goals to deliver more efficiency, happier workers, and greater business value .

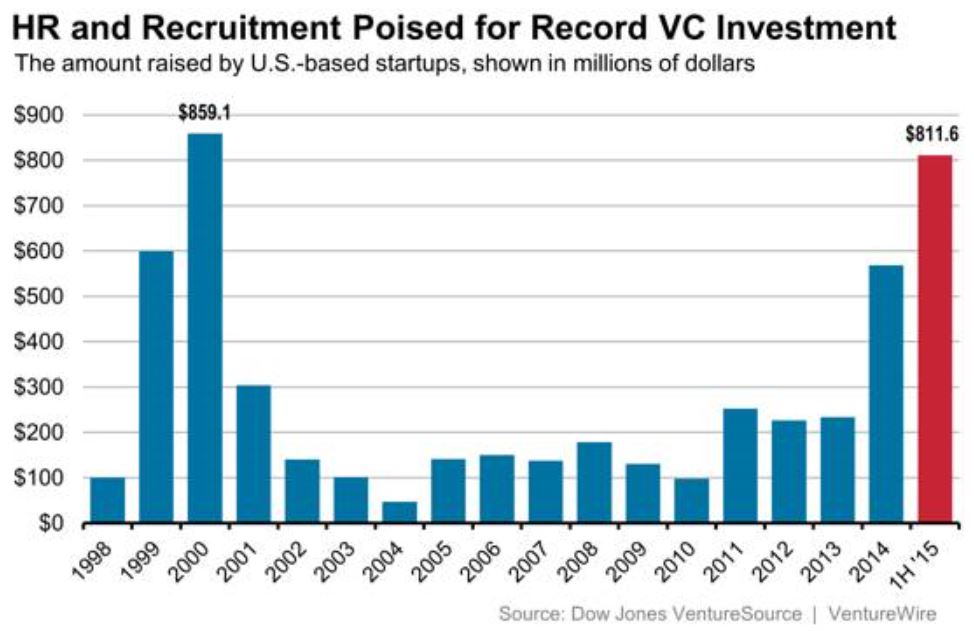

Billions of dollars invested in HR technology companies have created a handful of new and reborn one-size-fits-all HCM vendors who made a big splash on the HR scene throughout 2015 and 2016. Not to be outdone, niche HR specialist vendors have upped the ante with some very compelling niche products targeting recruiting, performance, learning, compliance, and social collaboration. Choice is always a good thing for HR departments. How does all this investment in HR technology companies change the way HR executives think about using technology within their operations?

Billions of dollars invested in HR technology companies have created a handful of new and reborn one-size-fits-all HCM vendors who made a big splash on the HR scene throughout 2015 and 2016. Not to be outdone, niche HR specialist vendors have upped the ante with some very compelling niche products targeting recruiting, performance, learning, compliance, and social collaboration. Choice is always a good thing for HR departments. How does all this investment in HR technology companies change the way HR executives think about using technology within their operations?  HR Cloud 9 is being in a state of perfect contentment with your HR ecosystem. Getting to HR Cloud 9 isn’t a trivial matter, and it isn’t about choosing one vendor to handle everything. The choices you make when building out your HR ecosystem will either form your utopia or nightmare. To get to HR Cloud 9, consider how your ecosystem will fair in the following areas. If you do, you’ll be well on your way to Cloud 9.

HR Cloud 9 is being in a state of perfect contentment with your HR ecosystem. Getting to HR Cloud 9 isn’t a trivial matter, and it isn’t about choosing one vendor to handle everything. The choices you make when building out your HR ecosystem will either form your utopia or nightmare. To get to HR Cloud 9, consider how your ecosystem will fair in the following areas. If you do, you’ll be well on your way to Cloud 9. The Corporate Psycho is an individual who systematically lies, coerces, intimidates, or otherwise instills fear in coworkers in the pursuit of power within an organization.

The Corporate Psycho is an individual who systematically lies, coerces, intimidates, or otherwise instills fear in coworkers in the pursuit of power within an organization. It’s really not about ageism. It is simply that a great attitude and passion to succeed trump years of experience and perfect qualifications nearly every time.

It’s really not about ageism. It is simply that a great attitude and passion to succeed trump years of experience and perfect qualifications nearly every time.